Find the money to grow your business and stop doing everything yourself!

Feel like you’re stuck doing everything yourself – and can’t find the money to grow your business?

Today’s episode will help you find the money you need to get help so your business can grow – and so YOU can get a break!

Just imagine…

WHAT IF … the money you need to grow your business is RIGHT right under your nose?

Scroll down to keep reading…

WATCH THE VIDEO:

LISTEN TO THE AUDIO VERSION:

CONTINUE READING….

A while ago on my Facebook page I asked, “What would you do differently if you TRUSTED that the money will keep flowing into your business?”

And everyone basically said they would invest to get help in their business (without feeling guilty or fearful) – so they can stop having to do ALL THE THINGS.

When you’re in the earlier stages of business, it can feel like you’re stuck in a place where you’re doing everything yourself to keep the wheels turning – but you’re not making enough money to pay somebody so you can get to the next level and free yourself up.

If that’s going on for you, then I want to challenge you:

What if the money to grow your business is actually there?

And what if the thing that’s getting in the way of unlocking that money to grow your business is mostly your THINKING?

So let’s talk about how your Money Habit Archetype – the way you’re innately wired around money – can actually stop you from seeing that the money’s right there .. and how it can stop you from accessing it.

(We’ll also talk about what some of the deeper-seated fears and limiting beliefs might be, that could be the REAL cause of you feeling like there’s not enough money to grow your business)

Plus, we’ll cover some practical tips so you can put a strategy together for finding the money to grow your business. And I’ll tell you exactly what I actually did myself.

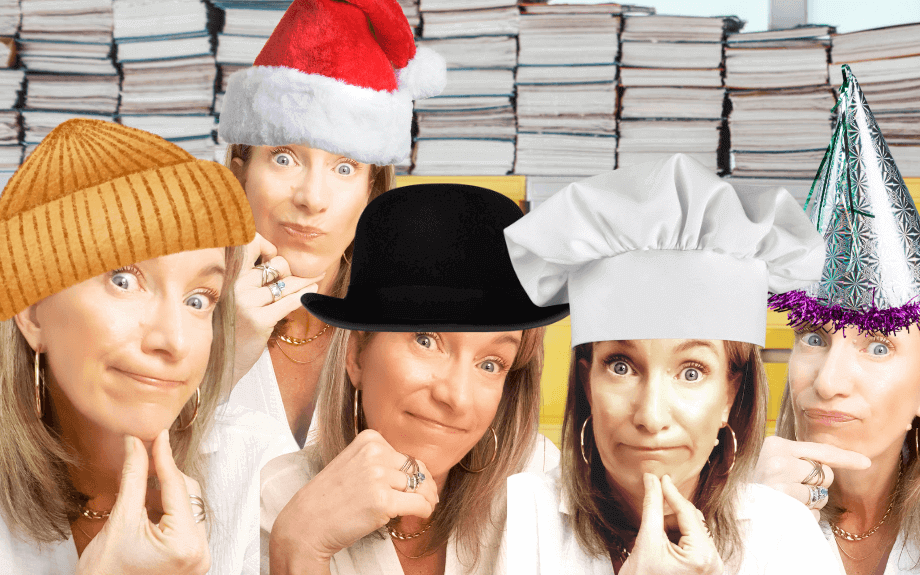

Wearing all the hats in your business is exhausting and there just aren’t enough hours in the day.

You’re trying to learn about SEO, building a website, a funnel, writing high converting emails, tinkering in Canva (but your graphics still come out looking a bit like Frankenstein..).

Then there’s Facebook Ads, Reels and all those endless glitches to deal with.

And while you’re trying to do all these things to grow your business, they leave you no time and energy to show up fully for your clients or to relax a bit and enjoy the fruits of your labor.

You end up having meals at your desk, staying up way too late, saying no to friends, watching a movie while working and missing the whole thing and basically not having a life.

It never ends. And when you’re in this state, you’re so tired and stressed that you can’t even think straight. All you can think about is getting back on that hamster wheel. And any time you step away from it and take a break, you end up feeling guilt and anxiety that you are not there, keeping the wheels turning.

It’s a very unhealthy pattern that creates a whole lot of stress & overwhelm and can end in total burnout.

So let’s look at your Money Habit Archetype and how it could be contributing to this situation.

There are 3 Money Habit Archetypes. The Accumulator, the Spender, and the Overextender. (If you’re unsure which one is yours or you’d like to find out more, just take this quiz)

1. ACCUMULATOR ARCHETYPE

Most of the Magnetic Money®️ Club members fall into this category. (And hilariously, they often think they don’t qualify to be an Accumulator because they haven’t accumulated enough yet!)

An accumulator is innately driven by the need to feel safe. They need that buffer, that safety net to know that all is okay.

But the problem is that when this comes from a place of fear of not having enough and not being safe – it’s never going to be enough!

They feel like they’re never quite in a place where they can risk some of their safety net for the purpose of growing their business.

They always feel like I need that money in reserve – just to be safe. And so if this is your thinking and your wiring, it means that even though the money might literally be right there, you may like it’s not available to you because you need it to stay safe.

It’s a really crappy thing to suffer. You have money but you’re still afraid. This is why I talk so much about creating a state of abundance that’s both internal & external.

Yes, we want the money in the bank. But we actually want to feel abundant and safe internally – and ideally, we want that feeling to be independent of the money in the bank.

So you resonate with being an Accumulator, time to be honest:

Is the money actually there – BUT you’re afraid to risk it?

2. SPENDER ARCHETYPE

The spender’s pattern is basically that money comes in and … whoops! There it goes again.

It’s coming in, but it’s also flowing out at pretty much the same speed. And interestingly, how much money comes in doesn’t change this pattern.

(In fact, none of these patterns are changed by the AMOUNT of money. We’ll get back to this in a moment because it’s important to recognize.)

If you’re wired to be a Spender, then you are going to be looking for ways to spend money the moment it comes in.

Spenders often come from a background where they didn’t have much money growing up – or they’ve had a powerful poverty experience.

And so they get used to “spending it while they can” – because tomorrow it may not be there.

So it’s actually a fear of not having enough tomorrow that makes them spend it today.

What can happen in business if you’re wired as a Spender, is that although plenty of money comes in, you’re spending it on things that aren’t really the highest priority.

You invest in courses or new equipment without really looking at the bigger picture and overall best strategy so you can use your money to grow your business – rather than just RUN your business.

And there’s a HUGE difference between the two!

3. OVEREXTENDER ARCHETYPE

The Overextender is the type of person who, if they win $10,000, will put a down payment on a car and take out a car loan.

They may actually end up in a WORSE financial position than they were in before.

When running a business with an Overextender pattern, it often means getting way ahead of yourself. Trying to do too many things, playing like one of the big boys when you still need to put foundational steps in place.

So you end up being spread too thin, doing way too many things, and that results in a lack of income. Because there’s so much going on that you’re not actually able to properly show up in any one of those areas.

Nothing’s getting traction and you’re doing ALL the things but without enough income to get help.

And you know what? The truth is that you’re not READY for help because you actually need to pull back and focus on the 1 or 2 main areas that WILL move the needle forward.

You’ll start making more money faster by reigning things in – and THEN you’ll be able to pay someone to support you so you can grow.

So that’s how the 3 Money Habit Archetypes affect your ability to find the money to grow your business.

And more money won’t change those patterns!

The same pattern will show up for small amounts of income, moderate amounts of income and huge amounts of income.

What can actually happen, is that as things get bigger and there’s more money coming in, the problems start to feel bigger & bigger too!

So you need to create a STRATEGY that allows you to grow your business from where you’re at.

It’s time to talk about some practical things to help you find that money to help you grow to the next stage. (and then the next and the next)

But first, let’s hit PAUSE & reflect before we move on:

Is this making sense? What’s coming up for you? Which Money Habit Archetype do you resonate with?

And most importantly are you starting to think that just maybe… you do actually have the money to grow your business – you’re just not using it properly, or not willing to spend it, or maybe your priorities are all over the place.

Are you starting to see that if you can change your pattern, you CAN get help to grow your business and stop having to do all the things yourself.

Let me know in the comments below!

OK, let’s get practical.

These tips will help no matter what your Money Habit Archetype is.

As is often the case, we’re going to start with a reframe.

See, most people think about getting help in their business in terms of a permanent commitment and a new ongoing cost.

And the reframe I want to invite you to make, is to think of breaking it down into STAGES.

So you want to ask, “Where do I need help in my business first? What’s the first (low value to you) task that you’d like to farm off to somebody else?

So number 1: Decide what that is.

(You know, instead of just randomly thinking “I’m snowed under. I need help!”

Get really clear on that very first priority.

THEN decide how you’re going to raise SOME money to get started.

For example: When I was building my finance business, I was burning the candle at both ends, working to grow the business around my 2 young children. I knew I needed help.

So I decided that I needed an assistant to do certain tasks so I could go out there and make more connections to grow my business.

I needed to GROW a little first, so I could then afford to pay someone ONGOING.

But initially, my target was to just have an assistant for 6 months so I could spend that time growing the business and have more clients coming in consistently.

Only then would we look at moving on to the next stage where she could become my permanent assistant.

At the time, I was convinced I could not afford to pay her that part-time salary. (Because I didn’t know what I know now so I was still doing everything the hard way)

But looking back, I know my business was making enough money. I was just spending it on all the wrong things.

So I actually took money out of my mortgage to fund those 6 months of salary.

I made it very clear that this was initially just a 6 month thing – the idea being that if everything worked out, she would end up having a fulltime job.

So that was our goal.

And so I want to encourage you to do the same – no matter how you fund this first stage.

Break it down & be really clear on the goal.

It makes it feel much more do-able and achievable.

Just set small goals and milestones you can reach, then move on to the next one.

It will stop feeling like a huge, scary commitment that you’re too afraid to step into.

It will save you time & money because rather than spending money on a course to learn a new skill – then having to spend the time to DO the course, become proficient at that skill AND do the actual work.

Instead of all that, you just get someone else to do it for you and it INSTANTLY frees you up!

Now, EVEN if you feel like the money’s just not there, you can STILL take the same approach.

Come up with a strategy to raise some funds – whether it’s having a special sale, making a special offer, or taking on a side gig.

Raise the funds, then use that money to pay somebody to free you from your business so you can achieve that first goal for growth.

When you think of it as this step by step process – rather than just trying to come up with a salary for somebody out of nowhere – it starts to feel so much more achievable.

IS FEAR OF SUCCESS KEEPING YOU BLIND TO OPPORTUNITIES?

If this is all making you feel uncomfortable – if fear is coming up, then you might suffer from ‘Fear of Success’

This is the fear of building a business monster. One where there are so many pieces of the puzzle and you’re locked in tighter than ever – with more people relying on you other than just your clients.

It’s the fear of having staff and contractors relying on you for their livelihood and that it’s asking more from you than you’re able or willing to give in the long term, but feeling trapped by the machine you’ve built.

That’s a real & valid fear! And it can absolutely happen. It happened recently to Vanessa Lau, a YouTube coach I follow. She built a multi-million dollar business in just a few short years, then realized that she had to walk away from it because it was burning her out and making her feel trapped.

In fact, I did a whole episode about it, which I encourage you to watch next (link below and here)

In that episode, we talk about the 5 key strategies and elements you need to ensure you’re not building a business monster.

It’ll help you ensure that Fear of Success isn’t unconsciously getting in your way, making you blind to all the opportunities for getting help so you can grow.

It’ll also help you create a building that feels aligned and sustainable so you love showing up for work and get to enjoy the satisfaction, fulfilment and FREEDOM you want.

So click on that next and I’ll see you over there!

CLICK HERE TO TWEET THIS EPISODE

RELATED EPSIODES: